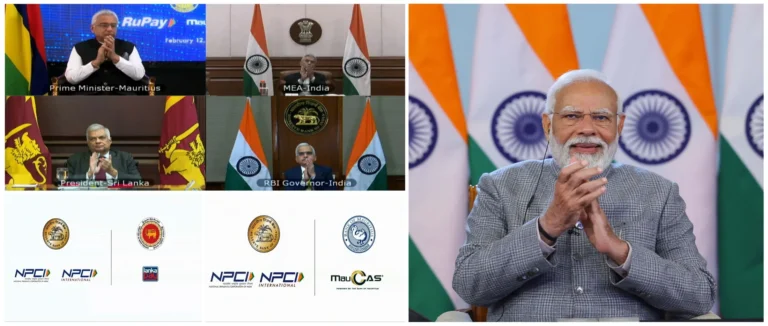

On February 12, 2024, Prime Minister Narendra Modi virtually inaugurated the launch of Unified Payments Interface (UPI) services in Sri Lanka and Mauritius, alongside the launch of RuPay card services in Mauritius. This marks a significant development in promoting digital payments and regional financial integration within South Asia.

Key Participants and Services Launched:

| Participant | Country | Service Launched |

|---|---|---|

| Prime Minister Narendra Modi | India | – |

| President Ranil Wickremesinghe | Sri Lanka | UPI Payments |

| Prime Minister Pravind Jugnauth | Mauritius | UPI Payments, RuPay Card Services |

Benefits and Significance:

- Faster, Cheaper, and More Convenient Transactions: UPI facilitates instant real-time peer-to-peer (P2P) and business-to-consumer (B2C) payments using only a mobile phone number and PIN, eliminating the need for card details or bank account information. This translates to faster, cheaper, and more convenient cross-border transactions for individuals and businesses alike.

- Increased Financial Inclusion: By enabling digital payments for those without access to traditional banking services, UPI can foster financial inclusion in Sri Lanka and Mauritius, promoting economic growth and development.

- Boost to Regional Integration: This initiative aligns with India’s “Neighborhood First” policy, strengthening economic and technological ties with South Asian nations, leading to regional integration and digitalization.

- Expansion Potential: The success of UPI in these markets could pave the way for further expansion into other regions, promoting India’s digital payment infrastructure globally.

Additional Benefits:

- Tourism and Trade Promotion: Easier cross-border transactions can boost tourism and trade between India, Sri Lanka, and Mauritius.

- Remittance Facilitator: UPI can provide a faster and more cost-effective way for migrant workers to send money back home, benefiting families and supporting local economies.

Challenges and Opportunities:

- Interoperability: Ensuring seamless interoperability between UPI and existing payment systems in Sri Lanka and Mauritius will be crucial.

- Consumer and Merchant Education: Raising awareness and educating merchants and consumers about the new services and their benefits is essential for adoption.

- Data Security and Privacy: Addressing concerns about data security and privacy will be critical to gaining user trust and confidence.

- Regulatory and Infrastructure Hurdles: Some countries may face regulatory hurdles or infrastructure limitations that need to be addressed for smooth implementation.

Success Factors:

- Continued Collaboration: Continued collaboration between governments, financial institutions, and technology companies is essential for overcoming challenges and ensuring the success of this initiative.

- Addressing Challenges: Actively addressing concerns related to interoperability, consumer education, and data security will be crucial for widespread adoption.

- Leveraging Existing Partnerships: Building upon existing regional partnerships and initiatives can accelerate progress and drive further integration.

Overall, the launch of UPI and RuPay services in Sri Lanka and Mauritius is a positive step towards promoting digital payments and fostering regional economic integration in South Asia. Addressing challenges and fostering continued collaboration will be key to realizing the full potential of this initiative.

Additional Table:

| Impact | Description |

|---|---|

| Economic Growth | Increased trade, tourism, and remittance flows |

| Financial Inclusion | Enabling digital payments for the unbanked population |

| Regional Integration | Strengthening economic and technological ties between South Asia nations |

| Global Expansion | Potential for UPI to expand into other regions |

| Financial Convenience | Faster, cheaper, and more convenient transactions |

I hope this detailed analysis and additional table provide a comprehensive understanding of this important development. Feel free to ask any further questions you may have.